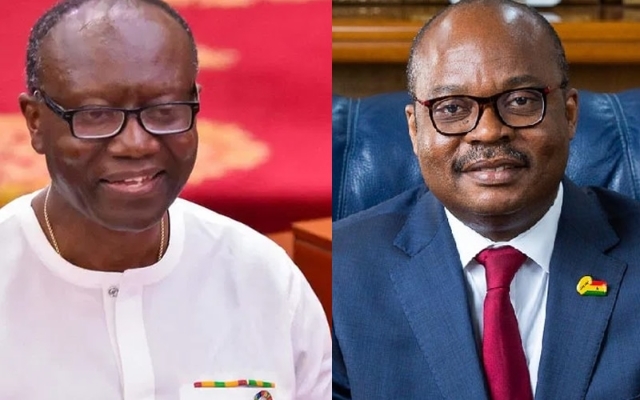

The Minority Caucus has served a note of caution to the Minister of Finance and the Governor of the Bank of Ghana (BoG) to get prepared for trial immediately there is a change in government.

The duo, Ken Ofori-Atta and Dr. Ernest Kwamena Yedu Addison, the Minority contends, are perpetrating crimes against the state with their blatant breaches of the country’s laws in the acquisition of a GH₵10billion loan facility from the central bank.

Mr. Ofori-Atta on Thursday, May 28, 2020 informed Parliament that government has made a move to access a GH₵10billion from the country’s central bank to partly address the fiscal of GH₵17.9billion due to the impact of the novel coronavirus on the Ghanaian economy.

The country’s fiscal gap was pegged at GH₵21.42billion after an initial assessment by managers of the economy. Funds from the International Monetary Fund, the World Bank and the Stabilization Fund of the country amounting to US$1.569billion has reduced the fiscal gap with the West African country still in need of GH₵17.9billion.

The revenue shortfall, according to the Finance Minister, will be sourced from both domestic and external markets, a GH₵10billion loan facility expected to be released by the central bank in an initiative the government has termed “COVID-19 Relief Bond Programme”.

The coupon rate of this loan facility is pegged at the BoG’s prevailing monetary policy rate of 14.5% with a 10 years tenor and 2-year moratorium on both principal and interest payments.

The decision to access the emergency fund from the Bank of Ghana is consistent with the provisions in Section 30 of the Bank of Ghana Act, 2002 (Act 612) as amended, Mr. Ken Ofori-Atta told a half-packed Parliament over the decision of government to access the emergency loan facility from the BoG.

The BoG, he further announced, has released the first tranche of the loan facility amounting to GH₵5.5billion to the Ministry of Finance.

This was done on Friday, May 15, 2020.

“This is consistent with global policy responses of Central Banks with large scale asset purchases to provide support to manage the pandemic”, Mr. Ofori-Atta noted in his address to the lawmakers.

However, the Minority says the move by government cannot just be passing on information to the legislature without seeking its approval for the loan facility which will add up to the country’s debt stock.

They also contend that the action by the Finance Minister and that of the Governor of the central bank is a breach of the country’s laws, especially, that of the Bank of Ghana Act (Act 612) as amended, cautioning that the duo will not be spared with the day of accountability comes.

“The time of accountability will come soon. Let nobody deceive you (referring to Ken Ofori-Atta) that you can do anything and get away with it. You may get away under your government today but tomorrow, you will be accountable for it. Some of these things accountability will come at the right time. I want to caution the central bank governor that he cannot act with impunity. This is the Act that governs the operations of the central bank. He cannot decide to do things contrary to the law. The time for accountability will come”, Ranking member of the Finance Committee, Casiel Ato Forson told journalists on the sidelines of Parliamentary sitting, Thursday.

Mr. Ato Forson who is also the MP for Ajumako-Enyan-Esiam constituency, Casiel Ato Forson, said the borrowing was needless, assuring that the Minority will resist any attempt to let such go through.

“We the Minority will resist this because we think they are only using it to finance election promises, particularly, the election year expenditures. We think that this is avoidable and is a waste and it should not be allowed. We want to serve notice to the Finance Minister that we are going to oppose this. Will not allow him. Already, they have breached the threshold and clearly what he is doing is not allowed”, he underscored.

He said per the dictates of Section 30 of Act 612 as amended, the country could only borrow an amount not exceeding 5% of the total revenue of the previous year’s revenue from the central bank.

Therefore, government going to the extent of borrowing GH₵10billion is way above the threshold which translates into 19.2%.

“The law is clear. It sets a ceiling and the ceiling is 5%. Section 30 of Act 612 amended says that “A principal enactment is amended by column 1 – the substitution of sub section 2. The total loans, advances, purchases of treasury bills and securities made under section 1 shall not at any time exceed 5% of the total revenue of the previous year’s revenue. Last year, the total was approximately GH₵52billion. So, 5% will give you about GH₵2.5billion. Today, they’ve already printed GH₵5.5billion and they want to do GH₵10billion. GH₵10billion will translate into 19.2% of the previous year’s revenue. I don’t know any government that has done that”, he explained.